All Categories

Featured

After registering, each bidder will get a bidding number from the Public auction Website that will make it possible for the bidder to put bids. All prospective buyers should make a down payment on the Public auction Web site prior to their proposals will certainly be approved. Each bidder shall make a deposit equivalent to 10 percent (10%) of the complete dollar quantity of tax liens the bidder expects winning.

Tax obligation liens are granted to the highest possible prospective buyer, or in the event of a connection, the victor will be selected at random by the Auction Site, and the winning proposal amount will amount to the quantity of the tie quote. Tax obligation liens will certainly be organized right into batches and offered in one-hour increments starting on November 6, 2024, at 8:00 a.m.

Workers and authorities of the City and County of Denver, and members of their families are not enabled to purchase at the Public Auction - real estate tax lien investments.

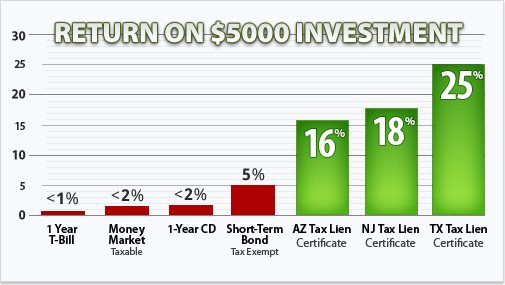

The Truth About Tax Lien Investing

There are no assurances revealed or indicated regarding whether a tax lien will certainly verify to be a profitable financial investment. The home information accessible on the proposal web pages was gotten from the Assessor's office prior to the start of the current auction and is for referral just (please note that this residential property info, provided by the Assessor's office, stands for the most existing analysis year, not the tax year related to this tax obligation lien sale, as tax obligations are paid one year behind).

Latest Posts

Tax Defaulted Homes For Sale

Property Tax Default Auctions

How To Find Tax Lien Properties